Refinancing loanTB

Transfer your loan online to Tatra banka and we will reward you up to 200 EUR.

Speed ??up your loan repayment with Extra Installments.

100 % discount on the origination fee

Interest rate from

5.99 % p. a.

(representative example)

Option to insure

the ability to repay a loan

Make sure that loan refinancing has its advantages

Refinancing loanTB offers you the opportunity to replace several existing loans with one new one under more favorable conditions.

Get:

- lower installment,

- a more favorable interest rate,

- preparation of the loan repayment request in another bank for you by us,

- additional funds,

- arrangement of loan refinancing in one visit.

What can be refinanced?

Loans from multiple banks

Loans in non-bank companies

Leasing

Refinancing calculator

Refinancing loanTB

Add another paid out loanAdd

New loan

Offer

New monthly payment will be lower by 0 €

Representative example:

Need more information about the Customer loan?

Leave us your phone number and we will call you.

This calculation is only informative – it is not binding for the client or bank and final values might change depending on the final interest rate determined by the bank under consideration of the ability of loan repayment.

This calculation is only informative – it is not binding for the client or bank and final values might change depending on the final interest rate determined by the bank under consideration of the ability of loan repayment.

- For a loan of 10 000 EUR with a fixed interest rate of 5.99 % p. a., by the maturity of the loan with the number of 96 monthly annuity payments and with a one-time loan fee of 0 EUR, the annual percentage rate of costs is 6.25 % with a monthly loan repayment of 131,77 EUR, while the last loan repayment is in the amount of 52,87 EUR. The total amount paid by the client is 12 571,02 EUR, while the interest calculation is based on the actual number of days in individual months and the assumption that the length of the calendar year is 360 days.

A representative example of the APR calculation for the Refinancing loanTB in the case of utilizing the Extra Installments benefit

- Assuming the loan applicant will also make optional Extra Installments of 35.00 € per month, the total amount the client will pay is 11 874,90 €. The loan will be repaid after 72 monthly annuity and Extra Installments.

Qualification conditions

You can get a Refinancing loanTB:

- in an amount from 500 to 40 000 EUR,

- for a period from 12 to 96 months (1 to 8 years),

- with a favorable interest rate from 5.99 % to 8.99 % p. a.,

- with an option of extraordinary loan instalments.

In cooperation with UNIQA insurance company you can arrange to insure your ability to repay a loan, which will give you certainty in the event of unforeseen events that might prevent you from continuing to repay the loan.

In cooperation with UNIQA insurance company you can arrange to insure your ability to repay a loan, which will give you certainty in the event of unforeseen events that might prevent you from continuing to repay the loan.

Where to apply for the loan?

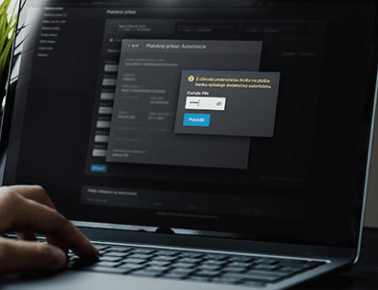

Web page

Calculate the repayment and apply for a loan in a few clicks.

Even without a Tatra banka account.

Frequently asked questions

If you have extra money, you can make an Extra Installment in addition to your regular monthly installment, up to three times the amount of your monthly installment. You decide the amount of the Extra Installment and whether to make it each month or not.

Simply use the "Extra Installment" feature in the application Tatra banka or Internet bankingTB to pay off your loan faster and save hundreds of euros on interest.

Accelerated repayment is an excellent way to pay off your loan and save money.

How to make an Extra installment? via the mobile app/Internet banking:

- Select the Refinancing loan from the list of loans for which you want to make an Extra installment.

- Click on the Extra installment icon and choose the amount of the Extra installment.

- Review and confirm the payment.

- The Extra installment will be processed on the regular loan installment date.

Payments exceeding three times the monthly installment can be made through a request for early loan repayment.

The interest rate from 5.99 % to 8.99 % p.a. is guaranteed for the refinancing of loans from other banks or from other consumer loan providers even for any outstanding loan balance – which you can get without documenting the purpose, so the money from this portion of a loan can be used for anything.

In the case of installment loans, it is sufficient to submit loan agreements for the transferred loans, or a request for early repayment with its quantification.

No, you do not pay the fee listed in the Service charges for a refinancing loan.

Do you need advice on refinancing a loan?

We will contact you with the best offer for you. Leave us your phone number.

https://www.tatrabanka.sk/en/personal/loans/refinancing-loan/