Personal Finance management

Get a better overview of your current and future financial situation thanks to the digital Finance management service.

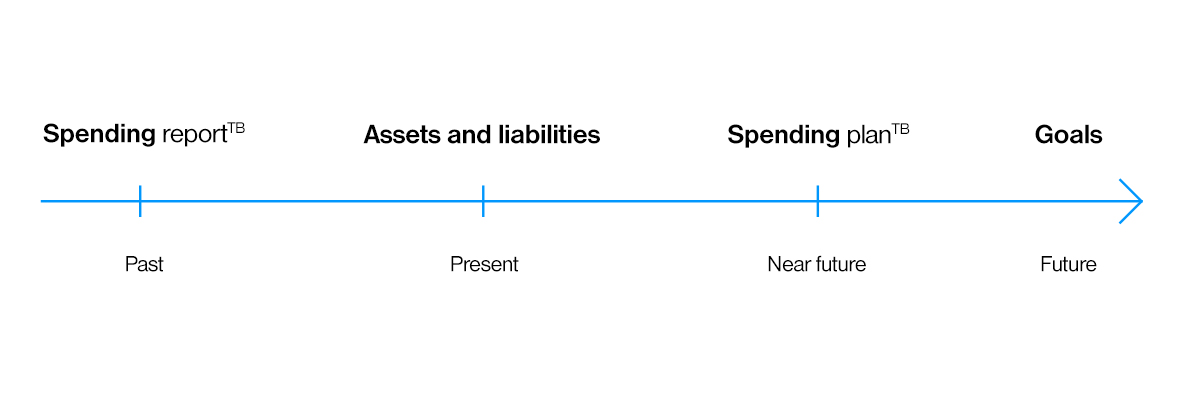

The digital Finance management service (MaFin), available in Internet bankingTB and in the Tatra banka mobile application, presents separate solutions aimed at more efficient management of personal finances:

Spending reportTB

- shows past income and expenses on checking accounts and credit cards

Spending planTB

- predicts recurring expenses for the near term

Assets and liabilities

- provides an overview of the overall financial and property situation

Goals

- allows you to plan the future by defining financial, savings or investment goals

The functionalities can be used by holders of the Account for blue planetTB or a Visa credit card.

MaFin functionalities

Watch demo

Spending reportTB

Spending reportTB provides an overview of income and expenditure in interactive graphs. It automatically classifies expenses into clear categories such as Supermarket, Housing Costs or Leisure. It is possible to set a separate budget in each category.

Thanks to this, you can more easily analyze your financial behavior and look for opportunities to save.

![]()

In general, experts recommend that you put at least 20 % of your expenses into savings.

Spending planTB

Spending planTB brings an innovative look into the near future. It shows you an estimate of how much money you have in your account until your next payday and what regular recurring expenses you have coming up:

- loan repayments

- standing orders and direct debits

- expenses based on past recurring payments, such as subscriptions for various services, payments to operators and other service providers, insurance premiums, school fees, etc.

![]()

In addition to regular monthly payments, Spending planTB also reminds you of less frequent payments. It can be an annual insurance payment or the purchase of a highway stamp.

Assets and liabilities

Assets and liabilities measure the difference between what you own and what you owe. You can refine the calculation by including all your movable and immovable assets, but also loans, savings and investments managed by other banks.

Goals

The Goals feature allows you to plan for the future in both the short and long term.

You can choose from a menu of preset goals or create your own:

- New housing or renovation

- Buying a car

- Traveling

- Financial reserve

- Property improvement

- A better pension

- An education or other goal for the child

- A goal of your own

![]()

Goals are displayed as a list or on a timeline. A simple indicator shows where you are in the fulfillment of a specific goal and can thus motivate you to fulfill it.

Spending reportTB

Spending planTB

Assets and liabilities

Goals

Life situations

Take a close look at your Spending reportTB, for example over a period of one year, and answer the following questions:

- Did every month end in the red, or were there months when the difference between income and expenses was in the red?

- Were the increased expenses seasonal, such as summer or Christmas, or were they caused by the purchase of more expensive goods, such as luxury clothing, sports equipment or car costs?

- Which categories are your biggest spenders on a regular basis? Can they be reduced by simply setting a budget for the category?

- Which expenses can be minimized or completely cut? It can be, for example, various trinkets, gifts, sittings, fast food and the like.

- Are there better-priced suppliers of some services on the market that create higher expenses and at the same time cannot be easily eliminated?

To maintain a stable financial and life situation, it is important to pay all your obligations. These are necessary living costs, such as paying rent, utilities, but also loan repayments, insurance policies and various regular payments.

The innovative Spending planTB will help you identify the regular planned payments that await you in the next month. These are set standing orders, bank loan repayments, advance payments, but also estimated payments that you have made repeatedly in the past.

After subtracting the planned payments from the current balance of your account, you will learn the value of the future balance on the account and you will have a better idea of how much money you can still spend on other expenses by the end of the planned period or whether you have room to put some money aside for savings.

The Assets and liabilities functionality will help you get a basic overview of the overall state of your finances.

It shows the total balance of products in the bank, and at the same time you can enrich it by registering assets and liabilities outside the bank. This way, you will see how many assets you have (property, house, car, savings, investments, etc.) and on the other hand, liabilities (bank loans, other debts and loans).

In the resulting comparison, you will get information about whether you have more property or loan items. You can then start thinking about strategies to further improve your financial situation.

Properly defined financial goals will help you plan ahead and be prepared for important life situations, such as studying at a university, getting married, having a child, buying a property or a car, or retirement.

You can define your goals with an estimated desired amount and target dates. Your financial future will no longer be a matter of chance, and you will gain more certainty and insight when planning it.

https://www.tatrabanka.sk/en/personal/account-payments/personal-finance-management/