First loan for your business development

Have you been in business for more than 9 months and have you filed at least one tax return?

Apply for the BusinessLoanTB Expres with simplified equipment and progress in your business.

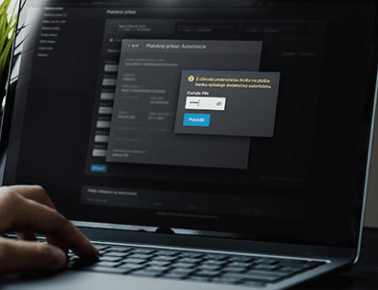

Arrange online

Since 9 months of business

Minimum required documents

Simple and quick processing

The advantages of a business loan for the development of your business

- Available to existing and new clients

- The possibility to finance any investment and operational needs related to your company

- Minimum required documents and express approval

- Security is only a form of warranty agreement

- Comprehensive advice in branches and via DIALOG Live

- Possibility to arrange key person insurance from UNIQA poisťovna or My company insurance from Allianz poisťovna

Details

- Form of loan: overdraft loan for 12 months or installment loan for a period of 1 to 6 years

- The loan is suitable for entrepreneurs with more than 9 months of business history and financial statements for the last completed year

- An entrepreneur cannot simultaneously have another business loan from Tatra banka or a credit card with a limit higher than 1 500 EUR

The amount of the loan depends on the length of business activity

| Length of business existence | The maximum possible amount of financing | |

|---|---|---|

| Less than 12 months | Up to 5 000 EUR | |

| Less than 21 months and 1 tax return filed | Up to 25 000 EUR | |

| 21 months or more and at least 2 tax returns filed | Up to 50 000 EUR |

Where to get a loan for the development of your business

You can arrange a loan for the development of your business online, by phone or in a branch:

Required documents

- Identification document of a natural person

- Documents proving business activity (e.g. extract from the relevant register)

- Financial statements for one or the two last completed accounting periods together with the tax return, if they are not published in the register of financial statements

- Confirmation of the filing of the tax return, if the financial statements are not published in the register of financial statements

- Additional documentation of the necessary documents depends on the type of specific applicant and the method of processing the request

What is an installment loan?

- An installment loan is a business loan that is suitable for financing investment plans.

- Quick loan withdrawal is made directly to the company account.

- You will repay the loan in equal monthly installments during the agreed period, while you always pay interest only on the currently remaining unpaid part of the loan.

Depending on the maturity of the loan, you can choose the appropriate amount of monthly installments.

Tip for you

Want to get quick information about financing options for you? Just enter your annual income.

What is an overdraft?

- An overdraft loan is a business loan that is suitable for financing operational needs or bridging a short-term lack of funds.

- It is provided in the form of an overdraft on a company account for a period of 12 months with the possibility of repeated and automatic renewal.

- If you do not draw the funds, you do not pay interest. You pay interest on an overdraft loan only on the amount you draw, not on the total credit limit provided to you.

www.tatrabanka.sk | Dialog: *1100 | Tatra banka a.s.

https://www.tatrabanka.sk/en/business/financing-options/first-loan-your-business-development/

https://www.tatrabanka.sk/en/business/financing-options/first-loan-your-business-development/