Tax on financial transactions (transaction tax)

The Financial Transaction Tax Act introduces an obligation for Slovak banks to pay tax on debit transactions, including cash withdrawals and card payments, on behalf of legal entities. It also imposes an obligation on entrepreneurs to have a transaction account.

To make it easier for you to navigate the topic, we have prepared answers to the most frequently asked questions. The answers also take into account the changes brought about by subsequent amendments to this act.

Transaction Tax:

Everything You Need to Know

Watch the video in which our colleagues: Peter Bilčík, Head of Corporate Products, and Pavol Bogár, Head of Small Business Client Segment, summarize everything you should know about transaction tax.

For the English translation of the video, please enable subtitles directly in the YouTube video and select the English language in the settings.

The video was published and contains information current as of March 19, 2025.

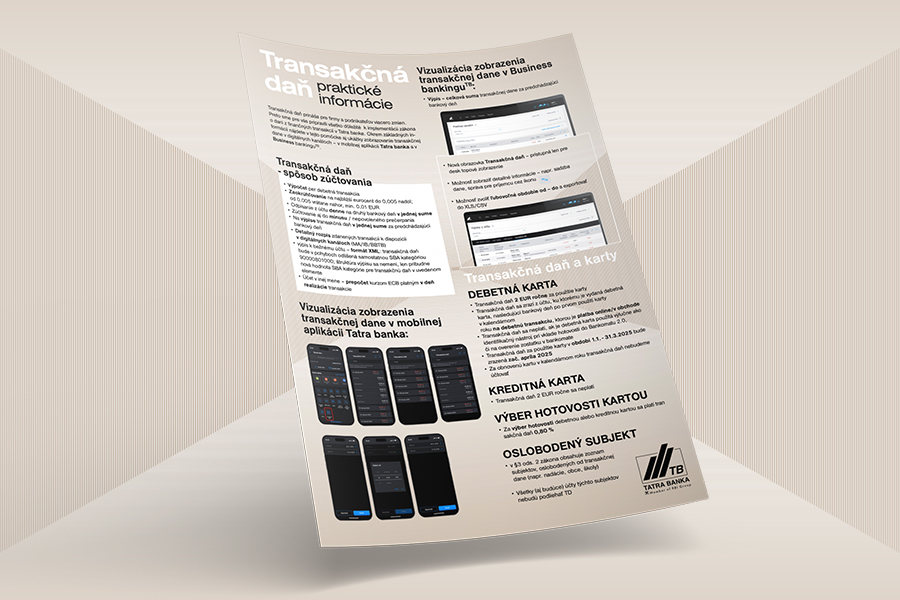

Practical Information on Transaction Tax

Check out the comprehensive guide on transaction tax:

Basic information on transaction tax

All debit transactions from a taxpayer's account are taxed, including cash withdrawals. Card payments should not be taxed at the rate of tax according to the amount of the payment, the use of cards should be taxed at EUR 2 per year for each card used.

The obligation to pay financial transaction tax is mainly imposed on legal entities, such as limited liability companies and joint-stock companies.

The rate depends on the type of transaction:

Non-cash transactions (for example, transfers from an account) have a rate of 0.4 % of the amount of the debit non-cash transaction, but a maximum of EUR 40 from each transaction.

For cash withdrawals, the taxpayer pays 0.8 % of the withdrawal amount, while the maximum limit of the tax paid is not determined. The rate also applies to withdrawals at a branch or by card from an ATM.

In the case of payment cards, a tax of EUR 2 per year is paid for each card issued individually and used at least once a year.

Examples of tax calculation:

- For a transfer of 1 000 EUR, the tax is 4 EUR, for transfers over 10 000 EUR, the tax is 40 EUR, so for a transfer of 50 000 EUR, the tax is also 40 EUR, since the maximum amount of tax is 40 EUR.

- When withdrawing EUR 1 000 in cash at a branch or from an ATM, the tax is EUR 8, while in the case of withdrawals there is no upper limit on the maximum amount of tax per transaction.

- If the client has 10 cards issued and used, he pays a tax of EUR 20 per year.

According to the law, the first tax period is April 2025.

In the case of a transfer of funds, the tax is deducted from the account of the person sending the payment (i.e. the sender, who is called the payer). In the case of a cash withdrawal, the tax is deducted from the account from which the cash is withdrawn.

Calculation and payment of transaction tax

In the case of a taxpayer with an account in a Slovak bank, the bank in which the client has an account will ensure tax settlement.

In the case where the taxpayer has an account in a foreign bank, the taxpayer himself (company, civic association, sole proprietor) is responsible for calculating and paying the tax.

Tatra banka withheld transaction tax from client accounts for the first time on 2. 4. 2025. The financial transaction tax for card use for the period from 1 January 2025 to 1 April 2025 was withheld from client accounts on 2. 4. 2025.

The bank calculates and deducts the tax from the taxpayer's account daily. The tax is calculated and deducted from the taxpayer's account on the day following the day on which transactions subject to transaction tax occurred on the account.

Tax on transactions subject to transaction tax is deducted in a single amount for the previous day. This means that if the taxpayer makes multiple transfers on the previous day, the tax is calculated for each transaction and deducted from the account cumulatively in a single amount.

In the client's statement, as well as in the account movements in the mobile application Tatra banka and Business bankingTB, the tax withheld for the previous* day will be displayed as a single transaction in a cumulative amount.

The details of the tax withheld for individual transactions will be visible to the client in the mobile application Tatra banka or in Business bankingTB in a special section.

*Note: Since Sunday is not considered a banking day, transactions for this day will be processed together with transactions on Monday. This means that tax for Sunday will be withheld on Tuesday. The same applies to holidays. ?

The minimum tax on a financial transaction is 1 euro cent. It is rounded to the nearest euro cent, downwards if below 0.005 euros and upwards if 0.005 euros or more.

Transaction tax and transaction account

Based on the amendment to the Financial Transaction Tax Act, effective January 1, 2026, the law no longer requires a natural person – entrepreneur to have a transaction account. Nevertheless, we recommend that self-employed persons separate their corporate and private finances, as it brings several benefits. These include:

instant overview of finances used for business;

- simplified management of accounting or tax records – the cost of accounting does not increase by accounting for private movements, when keeping accounts it is easy to distinguish income and expenses of a personal and business nature;

- personal transactions remain private – the accountant only has an overview of finances related to business, not private payments, also in the case of a tax audit, only the business account is usually audited;

- application of the full amount of bank fees to tax expenses;

- the opportunity to use various benefits that banks offer after opening a business account. Thanks to the use of their corporate account, self-employed persons can also receive advantageous offers for a pre-approved loan or credit card based on the turnover on the business account.

Yes, the entrepreneur will be required to conduct business-related transactions through a transaction account, which in practice means a business account. If the client does not already have such an account open, they must open one.

Yes, however, if the taxpayer has an account in a foreign bank, he is responsible for calculating and paying the tax himself.

Yes, the transaction tax applies to such fees as well.

The transfer of funds from a FO-P trade account to a FO current account will not be subject to transaction tax if both accounts are maintained at Tatra banka and/or Raiffeisen banka (organizational branch of Tatra banka a.s.).

No, operations between client accounts maintained in the same bank, including transactions where conversion from one currency to another currency takes place, are not subject to transaction tax.

For this purpose, you should consult your tax advisor. However, we do not currently provide such an option.

Payment cards

No, a fee of EUR 2 per year applies to the use of the card, regardless of the number of transactions made with the card, excluding withdrawals.

The financial transaction tax for card usage applies to those payment cards that are issued to a transactional account, which includes corporate debit cards.

The €2 per year tax applies to the payment card itself. If a client uses both a physical and digital version, it is still the same payment card, so they only pay once.

The financial transaction tax applies only to those debit cards through which taxpayer clients withdrew cash, paid in brick-and-mortar stores or on the Internet in a given year.

The tax does not apply to debit cards that were used exclusively as an identification tool in a given year when depositing cash into a Bankomat 2.0 or to verify the account balance at ATMs.

The first tax period for the financial transaction tax for the use of the Plynol card is from January 1, 2025, while the bank began calculating the tax according to the law on April 1, 2025. For this reason, the financial transaction tax for the use of the card for the period from January 1, 2025 to April 1, 2025 was deducted from clients' accounts at the beginning of April 2025.

From April 1, 2025 and in subsequent tax periods, the bank deducts the financial transaction tax for the used card always on the day following the first use and subsequent settlement of the transaction on the debit card in a given year.

Transaction tax and other Banking products

Automated compensation of account balances of taxpayers who are members of a consolidated entity for which consolidated financial statements are prepared are exempt from transaction tax, as long as they are carried out within a single bank.

No, the establishment of a term deposit is not subject to transaction tax.

Yes, principal and interest payments are subject to transaction tax.

Exemptions from transaction tax

The law provides many exceptions, some of which are listed below. The exceptions already take into account the latest approved amendment to the law.

Exceptions for debit transactions from paying tax:

- on the account of apartment owners;

- payments made in connection with the payment of taxes, levies, fees, and contributions that are income for the state budget, customs debt, and other payments assessed and imposed according to customs regulations, payments of contributions to the Social Insurance Agency and health insurance contributions, payments related to providing a guarantee for customs debt or other payments assessed or imposed according to customs regulations, payments for value-added tax or excise duty on imports, in connection with a security serving as a guarantee for fulfilling an obligation or meeting a condition arising from legally binding acts of the European Union in the field of agriculture, which are credited to an account held in the State Treasury, whose number or prefix is listed in the publication organ of the Ministry of Finance of the Slovak Republic;

- payment operations related to the management of securities or other financial instruments, or payment operations related to the purchase of securities or other financial instruments in connection with the management of old-age pension savings and supplementary pension savings;

- payment operations conducted between the taxpayer's accounts held with the same provider, e.g., a payment from a sole trader's account to a personal account of an individual at Tatra Banka a.s. or Raiffeisen Bank (a branch of Tatra Banka a.s.) or a payment between accounts of the same company within the bank;

- payment operations for the delivery or return of money from notarial custody;

- payment operations conducted on the account of apartment and non-residential premises owners in a building;

- payment operations conducted by payment card, except for payment operations involving the withdrawal of cash;

- payment operations conducted on a special account held by a court executor;

- transfers by a securities dealer;

- some payment operations related to public procurement, public commercial competition, and financial security.

According to the amendment of the law, the following are not taxpayers:

- Social Insurance Agency, Matica slovenská, Slovak Academy of Sciences, Office for Supervision of Health Care,

- budget organization and contribution organization,

- municipality and higher territorial unit,

- civic association, foundation, non-investment fund, non-profit organization providing services of general benefit, purpose-built facility of a church and religious society, interest association of legal entities, research and development entity, organization with an international element, Slovak Red Cross, and whose activities are according to § 50 paragraph 5 of the Income Tax Act,

- regional tourism organization, district tourism organization, tourist information centers,

- diplomatic mission and consular office based in the territory of the Slovak Republic, except for consular offices run by honorary consuls,

- diplomatic mission and consular office accredited for the Slovak Republic and based outside the territory of the Slovak Republic, except for consular offices run by honorary consuls,

- school and educational facility included in the network of schools and educational facilities of the Slovak Republic, except for a school and educational facility that is a commercial company.

Transaction tax declarations

The client must file a Notification for the purposes of the Financial Transaction Tax Act if:

1. he/she is an entity exempt from the transaction tax and does not have a confirmation of this in the Document Box in Internet bankingTB and the Tatra banka mobile application;

2. he/she carries out or will carry out in the future types of transactions that are not listed, but should also be exempt from the subject of the financial transaction tax according to §4, paragraph 2 of the Act.

Who can file a Notification for the purposes of the Financial Transaction Tax Act?

The notification may be submitted by:

- a person authorized to act on behalf of the client,

- a person with ownership authority to the account,

- an authorized person who can prove it with a valid power of attorney and an extract from the relevant register no older than 6 weeks.

The client can submit the notification:

- in person at any bank branch, while it is not necessary to fill out the Notification form in advance,

- through the DIALOG Live contact center *1100, from abroad +421259191000, while it is necessary that the authorized person has a pre-filled form, which he scans to the e-mail address provided during the telephone conversation,

- through his relationship manager (the completed form will be sent to his e-mail address).

In the Notification it is necessary to:

1. fill in the client's data: business name, company registration number, company's registered office address, name and surname, position, date of birth / birth registration number of the person authorized to act on behalf of the client.

2. select one of the following options:

- taxpayer - filled in by the client who is not a taxpayer within the meaning of the Financial Transaction Tax Act

- accounts - filled in by the client if he reports accounts on which he will carry out financial transactions that are not subject to tax under the Financial Transaction Tax Act - (specify specific IBAN)

3. fill in the place, date, name, surname and signature of the person authorized to act on behalf of the client.

The client can submit a notification:

- in person at any bank branch, while it is not necessary to fill out the Notification form in advance

- through the DIALOG Live contact center *1100, from abroad +421259191000, while it is necessary that the authorized person has a pre-filled form, which he scans to the e-mail address provided during the telephone conversation,

- through your relationship manager (the completed form will be sent to his email address).

Additional information on transaction tax

If the taxpayer closes a transaction account between April 1, 2025, and May 31, 2025, they are required to remit the tax to the tax authority for the taxable periods during which the account was active. They must do this by the end of the calendar month following the month in which the transaction account was closed. In the same period, the taxpayer is also required to submit a notification to the tax authority.

The current wording of the law does not include an exemption for salary payments, which means that every debit from the taxpayer's account representing a salary payment is subject to the transaction tax.

Entities that are not taxpayers can notify the bank of this.

The method and form of notification will be specified by the bank at a later date.

Yes, the tax will also apply to these entrepreneurs.

The taxpayer may request an explanation from the bank within 12 calendar months from the date the tax was deducted. The bank will provide the requested explanation in writing to the taxpayer within 60 days of receiving the request and will correct any potential error within the same timeframe. If the bank fails to fulfill this obligation, the taxpayer may file a complaint with the tax administrator within 60 days from the date the bank was supposed to provide the written explanation to the taxpayer and correct any potential error.

https://www.tatrabanka.sk/en/business/accounts-payments/financial-transaction-tax/